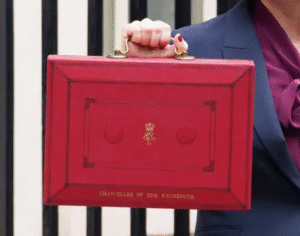

Chancellor Rishi Sunak on 24th September 2020 announced that the current Furlough Scheme will end on 31st October 2020 and be replaced by a new ‘Job Support Scheme’.

The purpose of this article is to help you understand how the Job Support Scheme will work and how you as an employer or employee may benefit from the Scheme.

What is a ‘viable’ job?

The Furlough Scheme was an emergency measure put into place to protect almost all jobs during lockdown. As such, we all knew it would have to come to an end, and, as the government has confirmed, it will do so on 31st October 2020.

On the basis that much of the economy has now reopened, the government has confirmed that the incoming Job Support Scheme will only support ‘viable’ jobs which ‘provide genuine security’. These are, in effect, jobs there is a current need for which aren’t currently being propped up by the Furlough Scheme. Therefore, only employees who can work at least a third of their normal working hours will be eligible.

What does this mean for those employees who normally work at venues that are still closed? Well, sadly, those employees, such as nightclub staff, live music venue staff and theatre ushers, will not be deemed to have ‘viable’ jobs and will not qualify for the Job Support Scheme.

However, even for those employees who do qualify as holding a ‘viable’ job, issues will undoubtedly arise due to a change in the publics’ general way of living. In particular, shop workers, hotel staff and travel industry employees may still lose their jobs when the Furlough Scheme ends. This may be due to ongoing coronavirus restrictions combined with people’s change in spending habits and a move towards online shopping.

What exactly is the Job Support Scheme?

The Job Support Scheme will assist employers by topping up the salaries of employees that cannot return on a full time basis. It will run for 6 months, from 1st November 2020 to 1st May 2021 and in order to be eligible, employees must work for at least one-third of their normal working hours.

In respect of the hours not worked, the government and the employer will then each pay one-third of the remaining wages. Accordingly, the employee will get at least 77% of their wages under the Scheme.

The government’s contribution will be capped at £697.92 per month. The application of the Scheme is perhaps best understood by way of an example:

Mr Bentley works at El Cuba, a Cuban restaurant, as a full-time Assistant Chef. He normally works from 3:00pm to 11:00pm, 8 hours per day; 40 hours per week. Mr Bentley earns £2,000.00 (net) per month.

However, due to the ongoing coronavirus restrictions, he has been informed by his employer that he will only be able to return on reduced hours. Specifically, Mr Bentley will be asked to work from 3:00pm to 7:00pm per day; 20 hours per week (or 4 hours per day).

As per the Job Support Scheme, El Cuba, Mr Bentley’s employer, will pay for the reduced hours he now works. This covers the period from 3:00pm to 7:00pm.

El Cuba will then be obligated to pay a third of Mr Bentley’s unworked hours, with the government also paying a third in respect of his unworked hours. Mr Bentley’s unworked hours equates to 20 hours per week, or 4 hours per day. Therefore, both El Cuba and the government will pay Mr Bentley for 1.33 hours of unworked time per day, with the remaining 1.33 hours unworked time per day being unpaid.

In conclusion, Mr Bentley will receive £1,000.00 from El Cuba for the time worked from 3:00pm to 7:00pm. He will then also receive £333.00 from El Cuba for unworked time, and £333.00 from the government for unpaid time.

Mr Bentley will receive £1,666.00 under the Job Support Scheme.

What does the Job Support Scheme mean for employers?

Clearly the bringing to the end of the Furlough Scheme will have a significant impact on employers who utilised it. Simply put, for the vast majority of the time, the government paid 80% of a worker’s wage under the Furlough Scheme. In contract, under the job Support Scheme, the government will pay a maximum of 22%.

Are you eligible as an employer?

The Job Support Scheme is open to small and medium sized businesses and larger business (subject to them providing sufficient evidence that its revenues have fallen directly as a result of the coronavirus pandemic).

Further considerations must be made by employers. Namely, those prospective workers it wishes to place on the Job Support Scheme must have been on the payroll since 23rd September 2020.

From a practical perspective, the Job Support Scheme has been engineered to be as flexible as possible. Therefore, employers will be able to move its workers on and off the Scheme as it sees fit, amend working hours and increase or decrease the amount of hours worked so long as each variation covers a period of not less than 7 days.

Importantly, employers will not be able to make workers redundant or place them on notice whilst they remain on the Job Support Scheme and a grant is being claimed on their behalf.

Are there other incentives for employers?

The short answer is yes, there are. The government will, as an incentive for employers to retain workers, provide employers with;

- £1,000.00 for every furloughed employee kept on until at least the end of January 2021;

- £1,500.00 for every out-of-work 16-24 year-old given a ”high quality” six-month work placement; and

- £2,000.00 for every under-25 apprentice taken on until the end of January, or £1,500 for over-25s.

Conclusion

In conclusion, Chancellor Sunak’s announcement of the introduction of the Job Support Scheme will come as welcome news to employees and employers alike who undoubtedly feared a potential cliff-edge regarding the Furlough Scheme ending and no further government assistance being forthcoming.

With that being said, there are continued fears that the significant increase in contributions employers will have to make under the Job Support Scheme in comparison to those made under the Furlough Scheme will render the Job Support Scheme as a disappointment, ultimately failing to live up to its purpose of reducing the rise in unemployment.